Redefining Theft - Legalized Plunder

Is a gang of nine mean looking, neck-tattooed, low pants wearing, gun-toting, Crips within their rights if they held a vote on the street corner, resulting 9-1 favoring the mugging the next guy down the street? (They graciously awarded the mug-gee a vote and assumed it would be "no".) Wouldn't they have acted democratically because they counted the dissenting vote?

"Oh no, that is stealing. Stealing is wrong, and against the law."

Follow up question: "Ok, What if those Crips never actually even threatened to hurt the victim, they never showed any weapons, they just asked for his money and he thought that he might be hurt if he didn't hand over his $100? Without force it would seem to be voluntary."

"Oh, no, that is stealing. They were obviously threatening and that is a crime."

Follow up again: "OK, What if they took only $90 of his $100 and gave him back $10? That would be $10 for each of them. Is this stealing yet? They all received an equal amount of money, including the victim, and no one got hurt."

"Of course it is. They took his money illegally."

"Why? They voted and gave him his agreed upon rightful share."

"Because stealing is against the law, and what you describe is still stealing. Plus, they voted illegally. They didn't vote it in a house chamber, or a state run polling station - they voted on the street. You can't have a binding vote on a gang controlled street corner by thugs. Be serious."

Follow up again: "OK how about this one. 9 Crips, and 50 million other like thinkers get together and vote into the House of Representatives people who are willing to make laws that allow the taking of someone's money without their consent. They intend to distribute this money mostly among themselves. If those targeted don't pay, they will be put in jail. If they resist jail, they will be forced to go. If they resist going to jail with enough resolve, they will ultimately be killed for civil disobedience. In reality they rarely have to physically hurt anyone, and prefer not to. Is it now legal to take their money?"

Answer: “You’re a racist.”

Since “Crips” are used in the above example, we are racists. Pay attention to debates between liberals and conservatives. Sure there are exceptions, but generally the liberal does whatever he can to limit the conservatives ability to get his point across. Interrupt, shout over him, call him names. Many are not really interested in free speech; they are interested in ensuring that rational opposing opinions are misrepresented. Those against Marxism and liberalism are demonized and trivialized in any way possible because the ends of the left always justifies their means.

In the above example we could change “Crips” that to a gang of nine southern white rednecks, or nine elitist New York college professors, or maybe democrats, or even republicans if you want. It makes no difference.

Those who want to legalize stealing are more powerful and can outvote those of us who have the money and don't want it stolen. They are using the police power of government to handle the mugging to raise capital for their own use and purposes. What is the difference? Our right to personal property has virtually disappeared and is now at the mercy of the voter.

“Theft” is not defined by how many people agree to steal. It is not justified if more want to than not. It is defined as taking something from another person without consent or permission. The fact that more and more people want to benefit from the production of others work, and vote to make it legal, does not change the reality that consent and permission has not been granted. Stealing is stealing.

Misguided morality is not just wrong it is immoral.

There are plenty of well-meaning but misguided liberals who honestly believe that stealing is wrong, and teach their children not to take things that don't belong to them. Some have to wonder though what message are the kids really getting. We question sometimes how they justify in their own mind that it is OK to take what other people have if they use a vote rather than a gun to accomplish it. Some call it intellectual dishonesty. I suppose that is better than calling them thieving liars who will defend anything that promotes their own selfish agenda.

They justify the things they want by espousing the virtue of sharing, except that they usually aren't the ones who are actually sacrificing. They ignore the obvious fact that it must be taken from someone else first. Or, perhaps they are contributing too, but they are in a position of distribution so will receive benefits of that "giving". It is not altruistic to give something to someone in need if what you are providing has been stolen.

Wouldn't it be wonderful if everyone just shared and no one ever went hungry or sick?

It would be great if everyone had air conditioning and a cell phone?

It would be terrific if every family had two bathrooms and three televisions.

Wouldn't it be fantastic if every child had a nice bicycle, a cool leather jacket and an I-Pod?

Wouldn't it be marvelous if only everyone would pitch in and do their share?

Since we can't move to Utopia, why don't we just make one here? Just because it has been tried many times before and the governments all devolved into absolute corruption, virtually enslaving their entire population only means we put the wrong people in charge. Now we have the right ones, so everything will be just fine.

Human nature is just that, natural. We can't change it. The only way to redistribute wealth is to punish one in favor of another. To reward a beneficiary, we need penalize a victim. Steal from one to give to another. It always has been, always will be this way, there is no other way to accomplish this.

The following is a short quote from a brilliant man, a religious man, a Pastor, a man of God who believed that redistributing wealth is fundamentally unfair, immoral and is absolutely not the role of government:

"You cannot legislate the poor into prosperity by legislating the wealthy out of prosperity.

What one person receives without working for, another person must work for without receiving.

The government cannot give to anybody any-thing that the government does not first take from somebody else.

- Dr. Adrian Rogers, (again) 1931-2005

Legalizing the act of thievery does not mean it is no longer theft; it means only that theft is no longer illegal.

The Poor Must Pay their Fair Share

Progressives constantly remind us that the “Rich have to pay their fair share.” They never define what that number is, what is meant by "fair share". Without knowing how much anyone actually pays in taxes they can somehow determine that they are not high enough. They rail that the wealthy are not paying enough taxes simply because there isn’t enough money to spend on the poor. When asked, most of those proposing that the rich pay more have no idea what they currently pay.

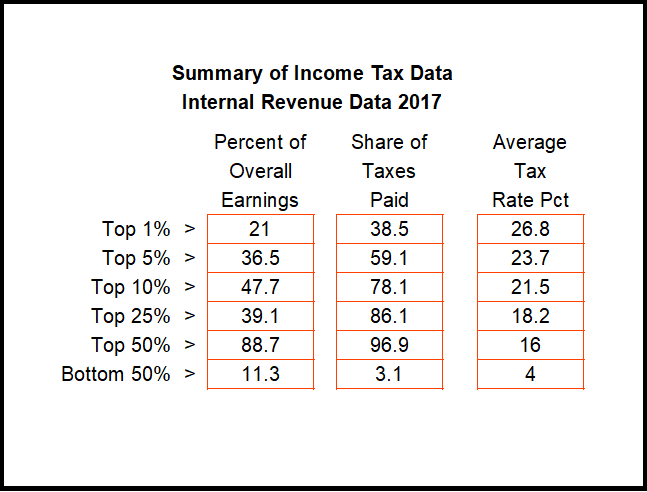

The following illustrates how much income tax each pays as a group. The top 1 percent pay over 26% of the income tax burden. The information is from the 2017 income tax data:

To the left, earning 21% of the money, but paying 38% of the tax is not enough.

So, the top 10% of income earners, those over $145,000 per year pay almost 80% of the income tax. The bottom half pays only 3%, and if we take it one level lower, the bottom 45% pay nothing.

This class warfare is exacerbated by people like Warren Buffett claiming that his secretary’s tax burden is higher than his own. I respect Mr. Buffett’s economic insight even more than his cousin Jimmy’s, although I do like Jimmy’s songs a lot better – however we have to take issue with the statement whose goal is to increase income tax because he is one of those liberals who has never had to sacrifice anything for his own family to pay tax – he is that rich. One of the wealthiest men in the world doesn’t have to worry if taxes go up a little – or even a lot. Let’s do all the math again.

When he states that his secretary pays a higher rate of overall tax than he does it is possible because of this extraordinary amount of tax free income, which of course is not taxed, his dividend income which likely taxed at 15% and capital gain income also taxed at 15%, his municipal bonds at zero. So if his secretary is taxed at 25% marginal rate, and he is taxed at a marginal rate of 35% on his earned income, it could very well be that she pays a higher percentage of her income in tax than he does.

When the overall percentage tax rate which includes millions of dollars of tax free and lesser taxed investment income overwhelms the earned income marginal rate to the point that the overall percentage rate is reduced in terms of a flat percentage rate. If his secretary earns $100,000 and pays $20,000 in tax, her flat rate is 20%; if he earns $100 million (earnings and investment, tax free investment income) and pays $10 million in tax, his rate is 10%.

I would call him a dope, but I know he isn’t. He is a disingenuous liberal, an intellectually dishonest but brilliant investment manager who doesn’t have to sacrifice anything for his family or himself because of taxation. He really can’t make the connection that a lot of the rest of us sacrifice our families every year in favor of government demands upon us.

If Mr. Buffett is suggesting that because he has so much tax free and minimally taxed investment income that we all should pay a higher rate, then I have a suggestion for him. It is perfectly legal to pay more tax than required. All he has to do is write a big personal check to the United States Treasury. Leave the rest of us alone, you know, those of us who are not bazillionaires.

If he doesn’t have the address, I offer it here. Also any Hollywood liberals or anyone else for that matter who believes the government can do better with your money than you can, please feel free to write a check payable to:

The “United States Treasury” at:

Gifts to the United States

U.S. Department of the Treasury

Credit Accounting Branch

3700 East-West Highway, Room 622D

Hyattsville, MD 20782

And stop your hypocritical whining and put your money where your mouth is.

No one's fair share is Zero

If the poor is defined by those lower 45% of income earners in this country, than I have to ask, why are they not paying anything? Where is their incentive for fiscal responsibility if they are not required to fund any of it? Is there any wonder why now we have polls that suggest pretty evenly that half of us want lower taxes and half want higher taxes?

The forty-five percent who pay nothing and expect only to receive benefits want higher taxes so they can get more stuff. Add to that a few percentage of the very wealthy like Warren Buffett, who for whatever reason, maybe they feel guilty for it, maybe they really believe it is best - but have never had to sacrifice anything for their own families in order to pay tax, and so from that standpoint don’t really have any skin in the game either. So we have nearly half of the people who believe taxes are too low. A combination of those who pay nothing, and those who pay a lot, but have so much, they don’t care.

The poor must begin to pay income taxes so they actually care how money is spent. They must contribute something; even if it is only in a small way, so that at least some of their money is wasted along with ours and is spent where they don’t want it to be – just like the rest of us who pay taxes and so care what happens to the money.

As earlier noted, most who call for higher taxes don’t really know who is paying the taxes. Many assume the wealthy somehow get away without paying taxes. This is not the case. If there is not enough for the poor, then the rich aren’t paying enough. If they knew that the top one percent earned only 20% of the income yet pay 38% of the taxes would they feel the same? How much is enough? All of it? At least years ago a poll tax was recognition that something should be required of all voters, but that was determined unfair. More on this later.

Many poor don’t know what the taxpayers pay because they are by and large not taxpayers. They are not interested in the facts. When they demand that we must pay our fair share, they don’t define “fair”. They can’t because they don’t now what it is now. What they really mean is simply we must pay more. No matter what we are paying now it isn’t enough because they still want something they don’t have, and we haven’t yet given up all the money to provide it. Mr. Buffett is worse than the uneducated poor because he knows better. He uses an argument he knows will resonate with the ill-informed even though he fully understands it is disingenuous.

The poor aren’t paying enough. By any reasonable measure, zero is not enough. They need to participate in the paying so that they will be as concerned as we are about where it is spent. The poor need to pay their fair share too. Call me crazy, but contributing nothing and then receiving the lions share of the benefits just doesn’t seem to be quite fair to me.

Next: Welfare: Safety net or Alternative Lifestyle