Fair Tax: Objections and Answers

Opposing Arguments and Answers:

Objection: I won't receive any more in pay check because my employer will reduce my pay to take home levels since that is what I am used to receiving and he can get away with it. If that happens, I won't benefit me at all.

Answer: It is true to a certain extent that an owner may want to reduce employee pay because employees may be able to accept reduced wages. It would be very unlikely that any possible reduction would be worse than current take-home pay because of normal competition. Salary is a negotiated agreement. Most employers will likely leave wages where they are because their profit margins won't be negatively impacted. Perhaps they would reduce pay slightly - by the amount of the payroll tax they must pay in your behalf now (a little over 7%). They would have no legitimate reason for retaining income tax part of the withholding amounts you currently are losing every week.

The improving economy competition will bring more and better jobs at higher wages. If employers try to take advantage and reduce pay significantly, they will lose valuable employees to others. It is more likely that very soon wages will likely increase at greater rates, not decrease.

Don't forget the Prebate. When you add the Prebate to your wages, you will very likely have considerably more to spend each month.

Objection: There should be exceptions to sales taxes. All new items or services sold should not be taxed. If this includes medical care, food and clothing and all other necessities of life, the poor will suffer more. How callous is that? It just isn't fair.

Answer: Since the price of these necessities should not increase due to the substituted embedded tax, there would be no "additional cost" and so it would not be relevant. Second, the Prebate is designed to allow for United States citizens to receive a check every month for each person in the household equivalent to the amount of tax expected to be spent on the necessities of daily life.

The framers of the Fair Tax believe family comes first. No tax should be paid until household and family necessities have been fully satisfied. The Prebate handles this very practically by reimbursing an amount to each citizen expected to be paid for those taxes in advance and every month.

Objection: The wealthy won't pay their fair share. Interest and dividend income won't be taxed.

Answer: The wealthy are smart, they arrange their affairs to pay as little in tax as possible. Yes they pay a lot now, but often they legally manipulate their finances to pay as little as possible by investing in municipal bonds and tax deferred or other tax exempt income. Many very wealthy retired people pay very little in income tax. They consume a lot, and so it is very possible that their effective tax rate will actually be higher under the Fair Tax because they will be paying 23% on everything they purchase. Since they buy a lot more than the rest of us, it will likely result in more tax payments, not less. It is kind of a progressive tax because the more we spend, the more we pay, although the rate would be fixed.

Under the current system, the wealthy spend far more, and are not taxed at all on what they spend. The money used for spending is often received by them income tax free.

Some working wealthy will see their overall contributions cut because they could be taxed as high as 40% or so now. If the goal is to punish all wealthy; then this isn't the tax for us. If the goal is to generate the same government revenues easier, more effectively and more fairly, then it is.

Objection: People will cheat. They will buy things and not pay the tax. Sellers will cheat, they will sell things without registering to pay.

Answer: People will always try to find creative ways to cheat, it is in our nature - but it will be more difficult under the Fair Tax than it is now. Currently around 175 million tax returns are filed by individuals and businesses. Many of them cheat now. More millions currently work under the table and pay no tax at all. Your friendly neighborhood drug dealer or Mafia hit-man generally works "off of the books", and so they do not pay very much tax - but they do go to Walmart. When they do, they will pay taxes and fund our corrupt government just like the rest of us more honest folk have to do.

So, next time you see your local hit-man at the grocery store, (you'll recognize him, he is the one in the nice suit, with the flat nose, narrow eyes, misshapen ears, and the bulge under his coat near his breast pocket) you can smile and say to yourself; "Finally he has to pay taxes too." Behind him in line may be your underground pharmaceutical merchant - (he is the one with the tattoos of dragons on his neck, and the white residue just beneath his nose-ring). You shake his hand and say "Thank you for shopping at Walmart and paying taxes just like me and for lowering my tax burden."

Objection: All kinds of jobs will be lost. Accountants, IRS agents, bookkeepers will become largely unnecessary and will have to go on unemployment or worse, welfare.

Answer: It is true. Though many businesses still will need to keep books and records - maintaining sales tax records won't be nearly as tedious or time consuming. Specific jobs will be lost in the shift, particularly in the tax preparation and related areas. Consider though that we are not talking about unskilled workers here. These are professional people who could do a many number of different things. The market will be so stimulated by the elimination of the income tax and the resurgence of the economy that most of these displaced workers will find it relatively easy to make a transition.

Objection: The wealthy will get the Prebate just the same as the poor. That isn't fair.

Answer: What is the definition of “fair”? The wealthy spend money on necessities too, they will receive the Prebate. First, if medical, food and clothing were exempted, they would garner an even greater benefit because they spend more in those areas simply because they can. Instead of Rahman Noodles, maybe they buy Filet Mignon. Instead of buying a $10 shirt at Target, maybe they buy one for $200 at Nieman Marcus. But their Prebate is not any more than the poorest of the poor even though they may spend and pay tax on "necessities" many times that of the value spent by the poor.

Another reason not to restrict prebates is that it would take another administrative department in government to oversee and determine who is rich and not eligible, and who is poor and eligible. This would mean accounting expense for everyone, perhaps even requiring something similar to an income tax return; no one wants that. The poor would also have to bear this expense to justify and prove that they are in fact poor enough to receive the prebate.

Keep it simple. Every legal citizen with a valid social security number gets the prebate.

Objection: Real Estate - The deduction for real estate mortgage interest will be lost. People won't be able to afford their mortgage and will lose their homes.

Answer: Correct - there will be no mortgage interest to deduct from your taxable income - Turn your light on in Marblehead. There no longer will be taxable income, so of course there can be no deductions from a tax that no longer exists. Hello? Anyone home?

But this question is valid: Will it be better or worse to own and pay for a house?

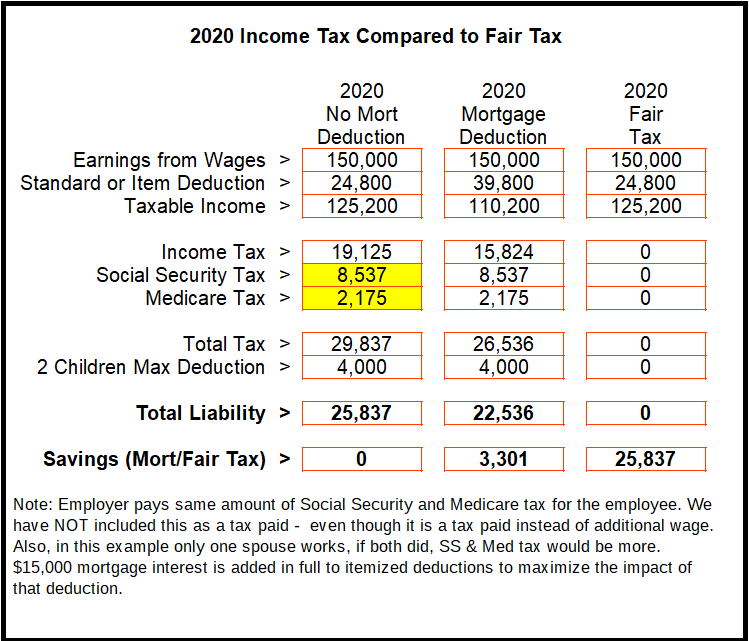

Let’s assume you earn $150,000 today and pay $15,000 interest on your home mortgage, generating maximum benefit from those interest payments. Under current law, your mortgage interest payments would save about $3,300 in tax. If the Fair Tax were implemented, your savings would be over $25,000, not just $3300,.

Don't believe it? See the table on next page:

Comparison of Real Estate Deductions and Fair Tax:

The preceding chart depicts a married couple filing jointly. They pay mortgage interest of $15,000. It assumes that in addition to the $15,000 in mortgage interest, that their other itemized deductions are equal to the standard deduction, allowing for maximum benefit, which is not always the case.

Here we add the mortgage interest to the $24,800 standard deduction and so they are allowed a total $39,800 in deductions. If they only have $10,000 in other deductions (like taxes, contributions and medical expenses), there savings would be far less. We show maximum benefit here so we can compare to the Fair Tax and without hesitation conclude that there is no comparison.

Which would you prefer. A mortgage deduction and a savings of about $3,300, or the Fair Tax and a savings of over $25,000? Is there really any question?

Objection: My state has an income tax as do most states. I will have to do just about as much accounting work as I ever did. It won't save me much in the way of time or tax preparation fees.

Answer: If the states don't change and implement something like the federal Fair Tax, they will very soon have a tax revolt and a non-compliance issue to deal with. They will find it has become much better government policy to do what the people want and employ a similar method. It is possible a state could do nothing. If they don’t alter their codes to match, plenty of other states will change and open their gates to refugees abandoning income tax sates. State income tax laws will evaporate very quickly.

Objection: Real Estate prices will go through the roof when adding 23%, combined with the non-deductibility of mortgage interest, this will lead to a meltdown in real estate prices.

Answer: Which is it? A meltdown or inflation through the roof? First we explained that the mortgage deduction will be irrelevant. When there is no income tax, there is no relevancy to any deductions.

The Fair Tax only taxes sales of new property. When you sell your house, the tax does not apply. (It is the same with cars and trucks. New cars and trucks would have the tax imposed, just as they had all of the embedded taxes along the way to manufacture them, so their prices should remain about the same). So when the developer builds a house and sells it to its initial owner, there will be that 23% tax. Like any widget or Miracle Gizmo, the embedded tax disappears and is replaced NOT ADDED TO the cost of manufacture - or in this case the building. So real estate prices should be about the same, just like everything else.

Objection: Capitalists will profiteer. Sure, you say the prices will drop and then adding back the fair tax will bring them to the same level as today. What about sellers and companies who want to profiteer from this. What is to stop sellers from just adding the fair tax and increase their profits at our expense?

Answer: Competition. Fair competition will stop them. First, a major retailer has already pledged to reduce all of its prices by 23% so that the sticker price you see on their shelves won't change. Since they are one of the biggest retailers in the world, there should be no worries from other retailers who must compete with them or suffer a rapid and painful death.

Could a company just try to profit unreasonably from this? Absolutely, but competition would drive their prices back down, or could force the more stubborn out of business.

There is a profit margin each company strives to earn. In some businesses it is more than others, but in general, if one company finds a way to reduce costs and maintain its acceptable profit margin, its competitors better do the same or they will lose sales and eventually go out of business.

You Liar! - Fair Tax is Really 30%

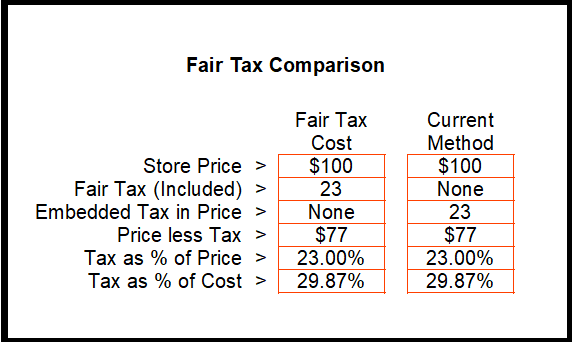

Objection: Fair Tax speakers lie. The Fair Tax is closer to 30% or more. If something costs 75 cents and is charged a dollar, that 25 cents represents 1/3 the cost, or 33%, not 23%.

Answer: True and not true. The reason we calculate it as we do is because the current tax included in everything we buy is an "embedded" tax cost. So although the Fair Tax is an add-on tax and is not embedded as is the payroll and income taxes to which it is compared, we have to mathematically equalize the equations for accurate comparisons. We examine the final price paid at the register of a store and "back out" both taxes for appropriate comparison.

If you prefer to claim that the Fair Tax costs 30% and not 23%, you will have to also agree that the payroll and income tax expenses are also about 30% as well. Suggesting that the Fair Tax is really 30% and the embedded income and payroll tax and related expenses is only 23% is completely inaccurate. The conclusion is that the Fair Tax and the embedded tax is the same, give or take a few pennies. The following table shows the tax calculated both ways:

If anyone claims that the Fair Tax Rate is not 23%, but in reality much higher they either don’t know about it, don’t care to know, or are intentionally misrepresenting it to dishonestly enhance their own faulty argument.

Objection: If the government is funded by a sales tax, what happens if everyone decides to stop consuming, or if they save their money and buy less stuff? Wouldn't that be a big problem?

Answer: Consumption has proven to be a far more stable and reliable source for taxation than has income. A good example is after the attack on the World Trade Center buildings on September 11, 2001. Quite a few people lost their jobs, and the economy fell drastically. These job losses obviously resulted in reduced income tax revenues as all times of unemployment tend to do. Income tax revenues fell sharply for several quarters after that attack because fewer people were working at the level at which they were previously.

Consumption did not suffer as serious a decline. Think about it. Working or not, we still must consume. Sometimes we borrow to do it; usually we can do it from earnings. In the absence of earnings, we still must consume. Consumption levels dipped slightly in the aftermath of the attacks, but not nearly as much as taxable income.

A consumption tax is a far more reliable source for government revenue than an income tax because it is much more consistent. The tax base is larger because it includes not only wage earning citizens, but also previously underground businesses, illegal ventures, state governments and foreign visitors too.

Wouldn't it be nice to see foreigners on our soil and know that they are contributing to our nation, welfare and tax system? When they run over us in line at Disney World, we can smile and say: “Thank you for paying for my Social Security.”

Next: Disengenuous, self-serving arguments against the Fair Tax