Fiat Money

Without going into detail, let me direct you to a book entitled “The Creature from Jekyl Island” by G. Edward Griffin. It describes the meetings held in the fall of 1910 between many of the robber barons at a resort off of the coast of Georgia owned by J.P. Morgan. They went there to discuss the re-ordering of our national monetary system by the institution of the Federal Reserve Act and the passage of the 16th Amendment to our Constitution – the Income Tax Law.

In addition to the robber barons and their representatives, Nelson Aldrich, the veteran senator from Rhode Island was the most prominent legislator there. They discussed methods of change and the steps that must be taken to bring them to where they wanted to be: atop the political and financial world.

The reason the robber barons needed the Federal Reserve and the income tax was to maximize the potential for creating “Fiat” money. Fiat money is money created out of other money. It is kind of like printing cash in the back room, but you need original certificates from which to copy. Eventually the press runs out of ink, the newly created money begins to fade away, but in the right circumstances you can get quite a bit out of the original printed supply.

Here’s how it works:

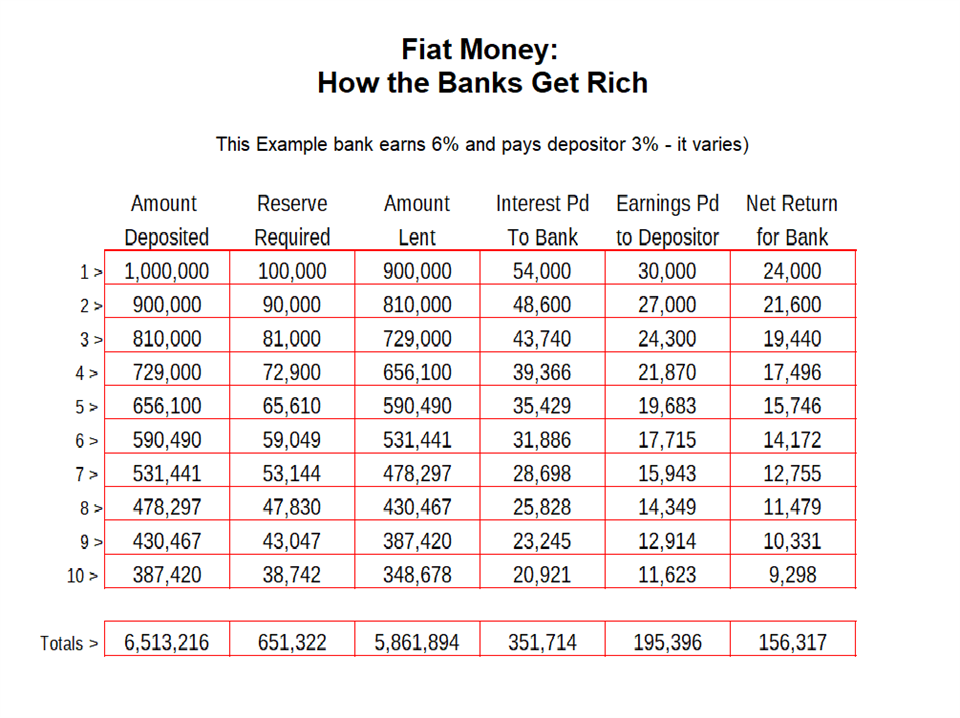

One of the primary components of the European system was the "Reserves" calculation. When a depositor comes in and deposits say, $1,000,000 into a bank, the institution needs to only maintain 10% of that money actually in the bank, part of which will be paid out as interest to the depositor. So the bank may pay 3% or $30,000 per year on that million dollars, and lend out the rest to businesses and sometimes to individuals. The other $900,000 or so, may be borrowed by someone to be spent to buy equipment, factory improvements, maybe even a large boat. What is done with the money is not of great concern, other than that acceptable collateral is offered as security.

On that $900,000 lent out, the bank may charge 6% or $54,000. This first transaction earns the bank $24,000; the $54K in annual interest earnings, less the $30K in interest that had to be paid to the depositor. This is just on a single initial deposit transaction in the first year alone. Not enough to earn on $1,000,000 dollars certainly, but keep in mind that it isn't the bank’s money at all; it belongs to the depositor. So to earn a net $24,000 on money they do not hold as a bank asset, but in reality is the property if an investor, is not completely unacceptable.

Whoever sold the equipment now takes his $900,000 and deposits it into any bank. Again we must keep 10% on reserve in the bank but we can lend out the remaining $810,000. Once more we pay the depositor 3% and earn 6% on a new loan of $810,000. A simplified ledger below tracks this “Fiat” money through several resurrections.

Of course these are only estimates for simplicity, but the numbers are fairly close to reality. Banks hold assets as well, such as stocks and real estate, acquired primarily as a result of turning lending profits into hard assets for themselves. Obviously lending provides the greatest potential for profit because they don’t need any of their own money to do it.

If you have $100 and earn $10, you’ve earned 10% on your money. If someone else has $100, and you earn $3 on their money, what percent return for you is that? By mathematical definition, it is infinity because you invested zero. Infinity is a pretty good rate of return. If I can get about 8% I am a happy guy.

Infinite returns come from lending, no where else. A great real estate investment may return 20 or 30% a year. The stock market could do the same for a time. Lending is far better. The potential return from lending is unlimited, as long as people are willing to borrow and able to repay – and as long as fiat money can be created.

It is critical to encourage not only rapid spending, but also a certain amount of "overspending" to maximize banking profits. Without borrowers, there clearly would be no debt from which banks could profit.

You can see from the preceding table that the bank can earn over $150,000 on just the first 10 loans from this initial deposit. If we continue the example to 30 transactions, you see where this is going. That’s a pretty good return by most standards, especially when you consider that it isn't even the bank's money to begin with - it belongs to the depositor. When the consumer does not wish to borrow, when money does not circulate as rapidly, they will not profit quite as much.

When we combine these transactions with a slight tax lifted from the citizenry at every transfer point, eventually government will be very well-funded indeed. Much better than relying on conjecture. Government has an appetite for taxation and is eager to assist in maximizing lending activity where possible.

How long will it take to generate enough transactions of this type to be worthwhile? We don't know. If it should require a year, the bank has earned quite a bit of money from nothing. Remember, the deposited money is not the property of the bank, but that of the depositor. At a significantly higher interest rate, fewer bank customers would be willing to borrow, and the results would not compare favorably.

There is risk of course. Depositors may all want their money at the same time resulting in a bank run, and naturally the money is not in the bank. Another risk is that borrowers may not repay the loans. With properly planned government guarantees, the loans will no longer constitute such a risk.

To reduce the danger of a run, The Federal Reserve will be authorized to issue and lend government backed money to banks from which to pay depositors. This will reduce or even eliminate that hazard when banks find themselves a little short

Eliminating the requirement that gold in some way backs every dollar will have to happen at some point. The currency can’t be inflated at the preferred rate while constrained by the limits of the gold standard. That obstacle has to be removed for this to fully implement. This can't work to its capacity if every dollar has to be backed in some way by gold. The amount of money to be created from nothing will be limited. Certainly these new regulations and the Federal Reserve will help immediately, but until the requirement for gold backing is eliminated, there would be unacceptable limits.

To try to eliminate our gold standard then – along with passing the income tax amendment and the Federal Reserve would be far too aggressive – even for the ambitious robber barons. When that limit is statutorily removed, they will be free to create almost as much money as they wanted. That will take a few years longer. They would need some kind of major serious financial calamity such as a war, or maybe a great depression to take advantage of a catastrophic opportunity. A good crisis can’t ever be wasted.

Full implementation can't be accomplished until that limitation is gone. However, the central bank combined with the income tax law was a great start. Those who have made those foreign loans, Morgan, Carnegie, and others - will now have the guarantees sought. It should make them all much more wealthy without the normal risk – even with the shackles of the gold requirement slowing the pace.

It was determined that a rate of about 3% offered the best combination of money movement and profit. At 3%, perhaps as much as 4% the circulation velocity would likely generate the greatest risk-free profit. No matter how well they planned, or how smart they were, they realized that they would have good years and bad, but if inflation is kept around 3 - 4% they should do very well indeed. Here again, this will be much easier without the gold restraint on the money supply and if bankers don’t have to maintain their own higher rate of reserves to protect themselves against a run.

They can’t call it inflation, it would be much better to begin to suggest a planned rate of "Growth".

As economic advisors to the country, a "Growth Rate" of 3% to 3 1/2 percent per year, every year, will be the goal forever. "Growth" is a positive term much like "expand" or expansion. Inflation is negative, more like "costly" or "expensive" or “tax”. The people will much prefer their assets grow than that their values have been intentionally inflated.

Let them see their houses increase in value. They will enjoy believing it is an "investment" in their future. Their bank accounts will swell if they choose to save. Sure, they will be in debt, but their assets will appear to be growing in value. This is a more positive and palatable outlook than announcing a target inflation rate. The public does not want inflation, they want growth. Growth is healthy.

The Possibilities are Endless

This is all fine and dandy, but what assurances do they really have that loans will never go unsettled? How do they know they can maintain our rate of inflation - I mean growth? They can't dictate spending.

Not yet.

The passage of the income tax amendment will guarantee payments. The government itself, by virtue of income tax requirements will assure that banks prosper. When the people see they are making money, when they perceive growth, they will accept the tax – in time. Most of them won't pay it initially anyway so they won't care.

The government will now have a stake in nearly all of the transactions listed on the above ledger. When the builder buys a piece of equipment, the equipment manufacturer has income, and therefore must pay some tax. When the department store sells a shirt, it will have slightly more income that day, and therefore be liable for a bit more tax.

The government will want to encourage as much lending as possible to generate as much economic activity to help fill their tax coffers. They will guarantee our loans with tax dollars because it will ensure their own cash flow. With this cash flow, the senators and congressmen can literally buy voters support as the government provides the citizenry with more and more benefits and comforts.

It will behoove the government to not only encourage spending, but over-spending. By overspending the people will be forced to continue to work in order to repay their accumulated debt. It will be up to the financial rulers to manipulate the interest rates to ensure its continuance for the good of the economy.

It will be clear that the more people spend, the stronger the economy will be, and the more income tax will be generated. Someone must make that shirt that you buy at the department store. That equipment sold to the farmer must be manufactured by paid employees who have mortgage obligations to the banks.

What does the government have to do with a farmer's payments to a bank on a business loan made to keep him shoveling his dung? Why would government give a crap about a bank being repaid?

Government guaranteed loans are expected for all kinds of business to keep the plan on track. For example, we all need to eat, and therefore we need farmers to grow and produce that food. It is in the national interest to guarantee that that farmer continue to be able to grow that food. The tax will provide guarantees that he stays in business and bank loans are repaid - with interest of course.

As inconceivable as it may seem something very interesting could occur. Hypothetically now, theoretically the government will have the power to pay farmers NOT to grow certain crops to limit supply and keep the prices high for those who do grow them. Those growing the crops make more money due to the higher prices and can pay back loans. Those who don't, may be paid by tax dollars for not doing so and will also be able to pay! (Could it be they thought of this way back then?)

Won't the farmers then be more likely to be inclined to prefer not to grow the crops? What if no one wants to grow anything? What if they would rather just sit back and collect money for doing nothing? Is this possible?

Of course that is a possibility, but should that occur, government could just withhold payments to the farmers for not growing food. That's all. They would have to grow food to be able to make any money. Government can regulate and de-regulate as it sees fit.

Come on now, paying anyone for intentional lack of production? Using tax revenues to entice farmers not to produce? Who could conceive of such a wasteful thing?

The point is only that if there were trouble in this area, they would have such extreme power that they could make something as outrageous as that happen for the good of the people because they have money in banks and do not want to lose it in a crash. They would buy into it to protect themselves. The idea would be sold as if it were to protect the people, not the bankers. Maybe they were reaching a little? Not everyone is a farmer.

The possibilities are endless. With these new regulations the potential is tremendous. Tax dollars could be used to guarantee bank loans of failing or even failed companies to bring them back to health.

For example, say a railroad company is about to fail. Who knows why; maybe it was mismanaged, lack of passengers or freight, bad weather. It doesn’t matter why. If they can't make money they could be about to close their doors. Certainly no bank would want to lend such a company any money, too risky. After all, banks are in business to make money for shareholders, not to accept bad risks.

Why not suggest that the nation needs this railroad for the "good of the country", the common good. We need to transport food. Arms may have to be moved should there be need of military action. Business travel is critical to keep the economy moving. We need a railroad for all kinds of reasons.

We can argue that if this rail company fails, thousands of people will be put out of work. It doesn't really matter that the company failed because it wasn't needed, or that the management team was incompetent, or even that a competitor was far more efficient and cost effective. The only issue that matters is that these workers, who have little or nothing to do, are now in jeopardy of being laid off. It won’t matter why.

A suggestion may be made that a hundred million dollars be lent to help keep this company afloat, to save the employees and preserve the potential access of necessary travel and freight. Banks could now be able to lend money to such a company in the future because the government, through the people's tax dollars will guarantee its repayment. This will enable banks to earn millions of dollars more on loans we never would have considered viable before, and keep the employees mortgages on schedule too because they won’t be laid off. A company like this would have been laughed out of the offices but now there is the potential to make millions on such loans – and without even the risk associated with a good loan!

The steel company that manufacturers the rails is necessary if the railroad is necessary. The ships that transport the mined ore to the steel plants are necessary for the same reason. The mines are critical to the whole process and must be kept open. The manufacturers of the mining tools must be kept alive. The potential is unlimited. The power will be enormous!

If this is done right money can be lent directly to the Federal Government, and payments will be guaranteed directly from them through income tax revenues.

Not now (1913) maybe, but with the potential of so much more money in receivables there could be thousands of new areas of spending. They can tax the people to pay for government spending work projects. Wars. It is a beautiful plan, and a war was about to brew overseas a great big one it appeared – that remained to be seen. Suppose the Navy needs a new destroyer and doesn't have the money. Maybe Morgan builds it through his shipbuilding company, charges the government 5 times more than it really should cost, Rockefeller lends the government the money to buy it on a guaranteed loan, and the government foots the bill for both. Everyone wins. Well, the robber barons win – the taxpayers actually have to pay it.

Suppose that the government can't pay back the boat loan from the current treasury funds. There are two basic options, both are good. First, they could sell bonds to the public to raise the money to buy the boat. Five thousand peasants buy $1,000 bonds payable over 10 years. Of course here we are again with the limitation of the gold standard, but maybe by the time these debts come due gold will be gone and they will be able to just print the money should collection revenues be insufficient.

The other simple option is to raise tax rates on the people in the name of safety. We tell them that we need this destroyer because there might be a war and we need it to protect them. How can anyone argue that there won't ever be a war? Or that safety is not important? Surely safety is worth the price of a few more dollars in tax. It is critical for all to know that no mater what, the government will never default on a loan – no matter how much its citizens have to pay.

It is a win-win situation, but it is dependent upon the Income Tax Amendment passing along with the Federal Reserve Act.

Next: Illegal Passage of the Income Tax Amendment