The Fair Tax

There is no question that no matter how much we detest taxation and government, there is a need for both to some extent. This alternative taxing structure as put forth by former Congressman John Linder and supported primarily by Neal Boortz, national talk show host as well as legions of enlightened followers.

Taxes are much too high, as evidenced by the disproportionately disturbing increase in the federal government's share of Gross Domestic Product as compared to the citizen's share. Government has too much money, therefore, taxes are too high. GDP is simply the money spent during the year. We are approaching 50% today. That means that only half of the economy is controlled by the citizens. In 1900, the government spent 7%, and we had the other 93%. No wonder we can't make ends meet anymore, we only have half our money.

Despite the harm the Federal Reserve has done, we do have to concede that at this point in history, there may be no way to return to an less-regulated competitive banking system as we had prior to 1913. If there is, I can't think of it. That said, if we can eradicate the other half, the income tax half of the Evil Twins, the Federal Reserve will have much less power alone. Like Bonny without Clyde, Butch Cassidy without the Sundance Kid, or Laurel without Hardy – the Federal Reserve just wouldn’t have the same impact without its evil companion.

This doesn't mean we lost the war on taxation too. We have a chance.

Significant tax reduction is the ultimate goal, but the Fair Tax does not reduce government spending, or overall taxation. The Fair Tax is a revenue neutral approach which projects to generate as much money as government is now absorbing out of the economy through the myriad of income and payroll taxes currently levied.

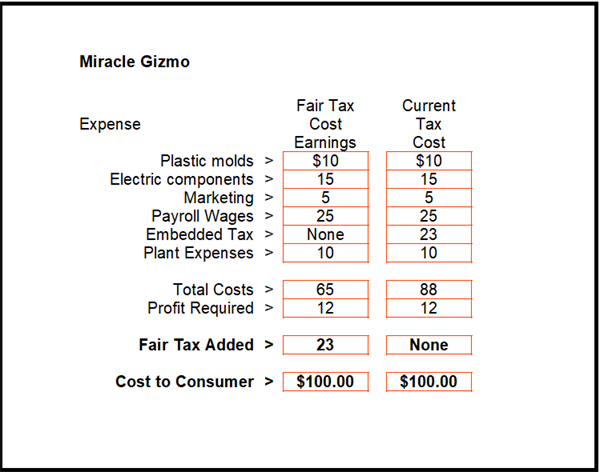

Embedded in everything we buy today is income and payroll tax. Like an ingrown toenail to a ballet dancer, the income tax is a constant irritation not only to the businessman, but also his employee. There are far better ways to fund a government. The following is an example of the cost to, and tax impact of an ordinary consumer item if the Fair Tax were implemented.

The Miracle Gizmo

A product comes to market, let's call it the Miracle Gizmo. It is an electronic device the size of a garage door remote opener. The Gizmo electronically locates all of those pesky things we constantly temporarily lose for hours or days at a time. It works either with different color lights, or an increasing sound of your choice. The closer you get to your lost item, the louder the sound, or the closer the color gets to red, you know you're getting warmer. Your keys, your glasses, TV remotes - whatever you program, pocketbook or wallet, your spouse - whatever you might lose, this handy dandy little hi tech doohickey will, after proper programming, locate your habitually lost items.

Like any manufacturer, the management and board of directors of the Miracle Gizmo' goal is to make a profit for its shareholders. (It doesn't matter what is manufactured, "Widget" is a little overused in these types of examples, so we made something up a little more interesting for you.)

In order to bring a Gizmo to market, costs must be calculated to arrive at a price they believe they can charge for it which will be profitable enough to make production worthwhile. It goes something like this - keep in mind this is a very simple example; there could be many more cost categories. This is not meant to be an advanced accounting course.

To estimate the cost of marketing the Miracle Gizmo, we have to consider taxation in several forms, some of which are already pre-considered by our suppliers in advance to arrive at the price they charge us for our materials.

First, there is the payroll tax the employer must pay on behalf of the all employees. Employers pay over 7% in tax for every employee for Social Security and Medicare.

Next, there is corporate income tax, which can vary, but would be around 25% of profits, sometimes lower.

Next are accounting and payroll expenses. In order to comply with the tax laws, these can be another 5% or sometimes more.

Don't forget the taxes along the way paid by the suppliers. The plastic manufacturer also pays payroll taxes, as do all of the other providers to get the Gizmo on the shelf. These come to about another 5% or so. They are already in our costs of purchasing materials from other companies, but are real costs none-the-less.

The total cost of taxes paid but unseen at the sales register in the production of the Miracle Gizmo is about 22 - 24% per unit. This does vary, but according to very expensive research done by top economists it is calculated to about 22- 23% of everything we buy. We use $23 in this example because that is about the average nationwide.

OK, you're wondering why if we have 5% here, 7% there another 5% here and 25% there why isn't the embedded tax cost over 40% and not just 23%? Some of those costs are born by others, and passed on in the form of pricing. So a 10% cost to the manufacturer of the electronic components for example may only be an additional cost to Marvel of 3% or so in additional expense. These circular calculations are tough - even for Excel, so we rely on the Beacon Hill Institute at Suffolk University and Dr. Lawrence Kotlikoff, Professor of Economics there to provide the boring details. Suffice it to say, the number is about 23% for more details, see the report from Suffolk University. They've spent over $20 million dollars analyzing this. Since I personally came up with a similar tax cost of production and sale using my own crude analysis techniques, I am very comfortable with their number.

If the Miracle Gizmo costs consumers about the same - give or take a few pennies, then why bother?

The Miracle Gizmo you buy in Walmart will be the same price under the Fair Tax as it is under our current unintelligible complex system. Rather than offering the Gizmo for $75, they must price it at around $100. If they earn $12 on each one sold, they would have to pay tax of about three dollars, which is also embedded in the price of the unit - somewhere.

That settles it. The Gizmo will be priced at $100 per unit because embedded in the cost of production is about $23 in tax that must be paid. This is a real cost of production and must be included, otherwise, Miracle Gizmo will lose money on every sale, or the profit margin will not be acceptable enough to produce the gadget. They can't survive losing money on every sale, - after all, they are not General Motors. They must count all the beans.

Many of you have heard of the Fair Tax, for those who haven't the following is a brief description:

The "Fair Tax" is a national sales tax expected to be set at 23% to be collected by the seller on every new item or service purchased, no exceptions. It is to replace all of the income and payroll taxes currently on the books, it is not in addition to them. When implemented, all income taxes and payroll taxes will be repealed.

Prebate

Because it is believed that no one should pay tax on the necessities of life, a "PREBATE" will be sent in cash to each citizen with a valid social security number every month. This amount will be calculated and be set at the amount determined to be the sales tax that likely would have been paid at the poverty level. Current estimates indicate that would amount to a check for about $160 or so per person per month. So a family of four would receive approximately $500 or so every month in addition to whatever they may have been able to earn.

NOTE: the prebate for a family of four would be closer to $500 than to $600 because the total amount per household declines a little as family size increases. A family of 10 would not receive 10 times the single amount because 10 people in the same house do not buy 10 times the daily living necessities of one.

Rather than force the expense of the filing of 175 million individual and business tax returns to raise money, why not instead embed that 23% at the point of original sale? Like the state sales taxes that are so prevalent, the money will be collected at the register of retail stores, or at the point of service when other goods and services are sold.

Now if you've followed the logic, you will realize that this is not an additional expense of 23% it is replacing the 23% previously embedded. So rather than offering the Gizmo at $100, Marvel Enterprises, parent company that manufactures the Miracle Gizmo can offer it at $77 or maybe $79 because the embedded tax of $23 or so is not part of their cost equation, and their profit is still $12 per unit sold.

You go into the store, and see the gizmo on the shelf. Its price tag reads $100. You wonder why because you thought it would be cheaper. Well, the Fair Tax has been added at the shelf, so you pay the $100, about the same as before. There is not an additional 23% more at the register. It is still $100.

So what's in it for me you say? If I have to pay the same for the item, where is the consumer advantage? Simple. You're taxes were also a part of the embedded tax that has been eliminated in favor of the Fair Tax. This is a very complex circular calculation.

Maybe you work for a company that provides the electronic components Marvel bought to make the Gizmo. No tax has been withheld from your pay. Maybe you work for a company that delivers to Marvel. Since that company paid no embedded tax, Marvel paid less for the deliveries. It is made up at the point of sale.

The portion of our pay we have been accustomed to calling "take-home" pay will be an expression of the past. If your gross pay is $1,000 per week, that is what will be on your check. You will now deposit into your bank account the full $1,000 instead of the $725 or so that you were used to clearing. So the wages you are allowed to keep has risen to the level of your gross pay. You will have far more money to spend.

Are Fair Tax opponents purposely lying, or just stupid? We think lying.

Don't be fooled by opponents of the Fair Tax. They like to tell us that it is some kind of boondoggle for the wealthy, and another dagger in the hearts of the poor. Even Steve Forbes, who apparently has his own agenda, is spouting this nonsense and, rather than attacking his motivation, intelligence or honesty, let's just say we believe he knows better.

Every new item sold, from real estate to Miracle Gizmos will have this Fair Tax attached to it. It is a replacement of a previously embedded tax, not an additional tax. To the purchaser, it would result in nearly identical cost as before except for the fact that the purchaser would have a bigger personal paycheck every week to buy more stuff.

There are many arguments against the Fair Tax, most of which use the same tired old approach to appeal to the more stupid and dependent among us: It is only to benefit the rich; It exploits the poor; it will have to be a lot more than 23%; it will foster massive tax cheating. If you have any more questions about it after reading our FAQ's please buy one of the Fair Tax Books.

Next: False criticisms and real answers